Jalan Pahat H15H Dataran Otomobil Seksyen 15 40200 Shah Alam Selangor Malaysia. Malaysia custom hs code Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission.

Hs Code All About Classification Of Goods In Export Import

For more information on myTRADELINK please contact our Careline.

. 03- 5523 1819 Fax. Ad With Avalara item classification youll get more accurate tariff codes faster. Please note that certain items.

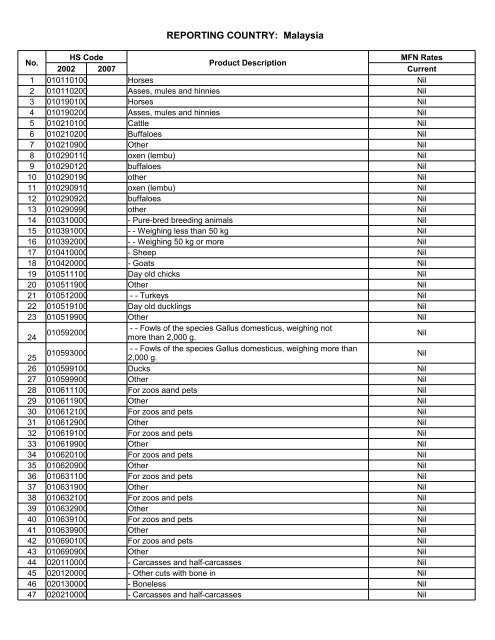

This new Customs Duties Order 2022 is in line with the release of the seventh edition of the Harmonized System HS 2022 by the World Customs Organization WCO. 100 - - - For zoos and pets 0 0 0 0 0 0 0 0 900 - - - Other 0 0. Our Malaysia Customs Broker can assist you to calculate import and export Duty charges.

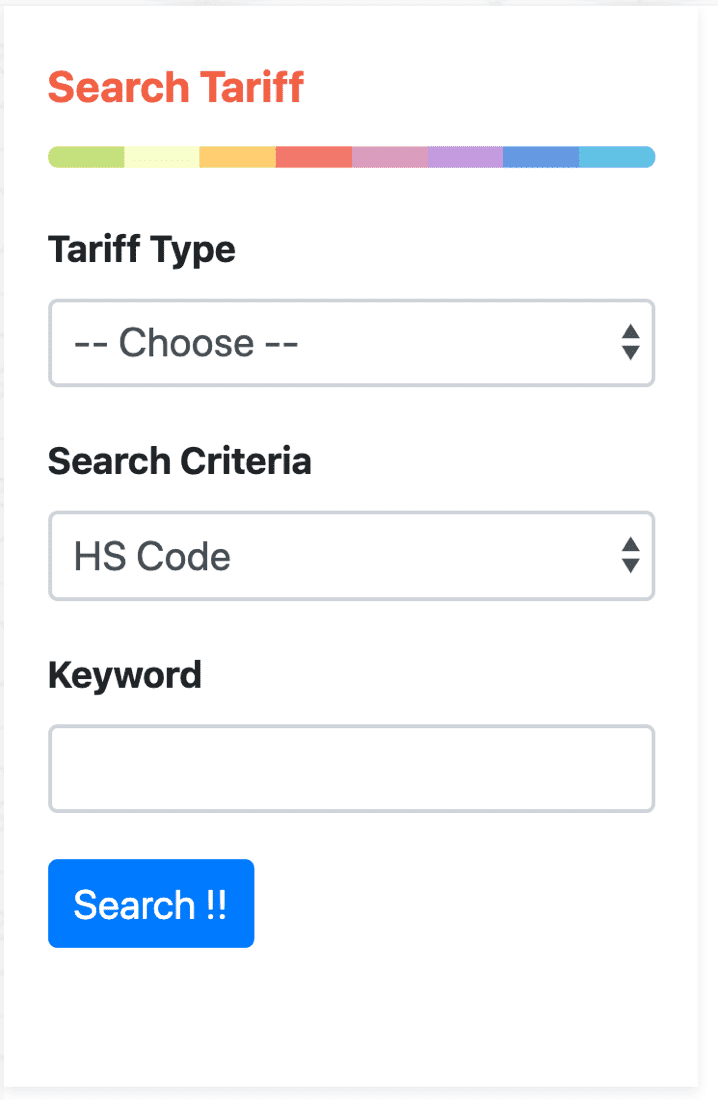

Into correct tariff codes to determine the amount of duty. Importer must declare Customs Form No. Ad With Avalara item classification youll get more accurate tariff codes faster.

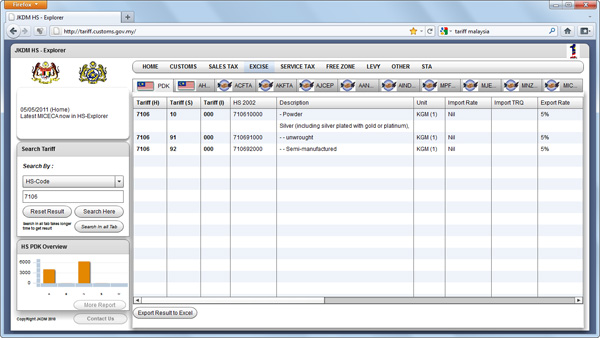

Hak Cipta Terpelihara 2018 Jabatan Kastam Diraja Malaysia. Failure to classify product correctly will not only involve. 1 300 88 8500 General Enquiries Operation Hours Monday - Friday 830 am 700 pm email.

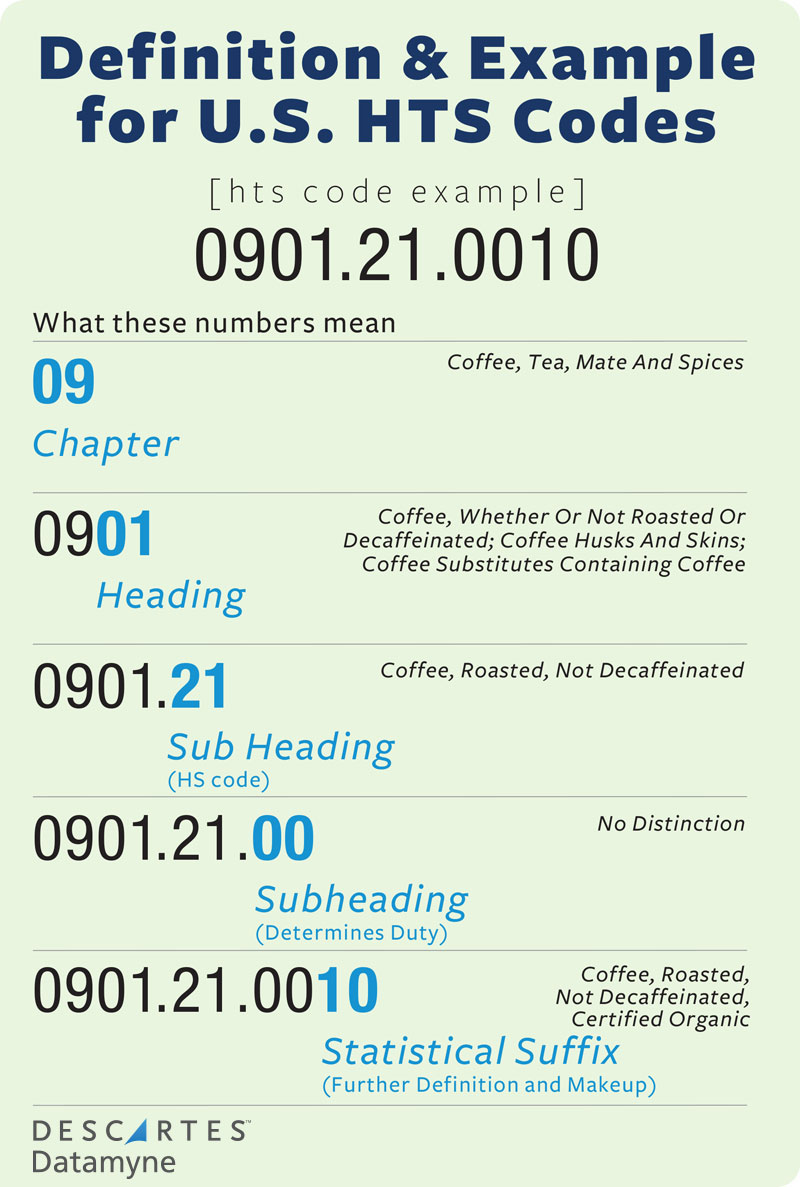

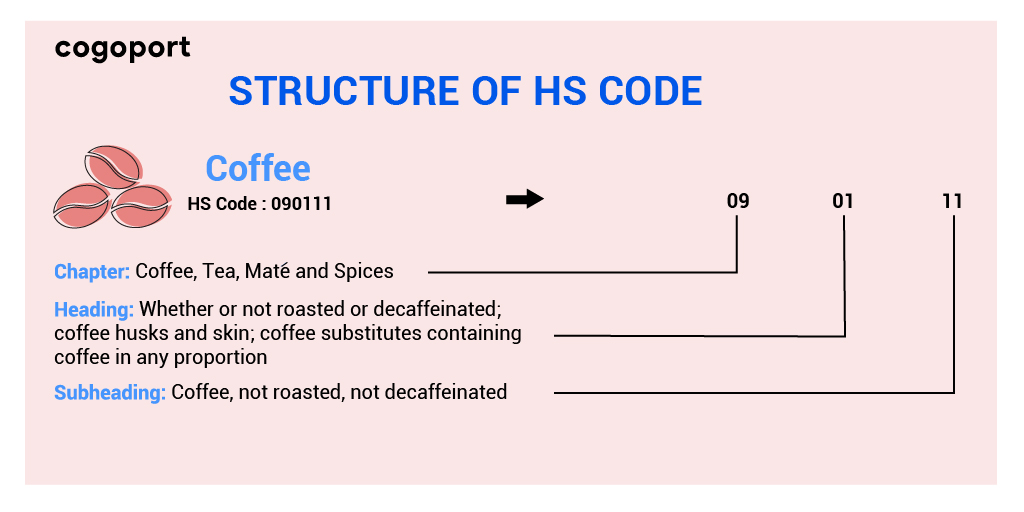

Classification and duty allocation for items are done at Valuation and Tariff Section. For further enquiries please contact Customs Call Center. Malaysian Customs Classification of Goods entails classifying products into correct tariff codes to determine the amount of duty payable.

Extension Of Payment Date For Phase 1 Of Special Programme On Indirect Tax Voluntary. Malaysias tariffs are typically imposed on a value-add basis with a simple average applied tariff of 61 percent for industrial goods. Administrative rulings concerning tariff classification include.

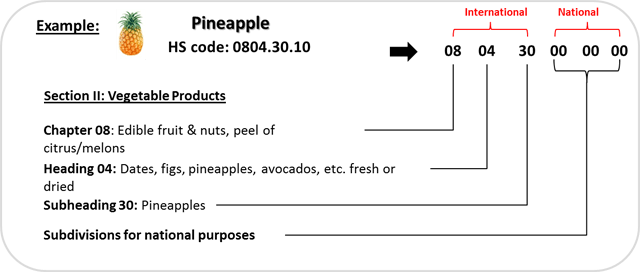

Last published date. Fire Natural Disaster and Losses. Items are categorized according to Harmonized Commodity Description and Coding System.

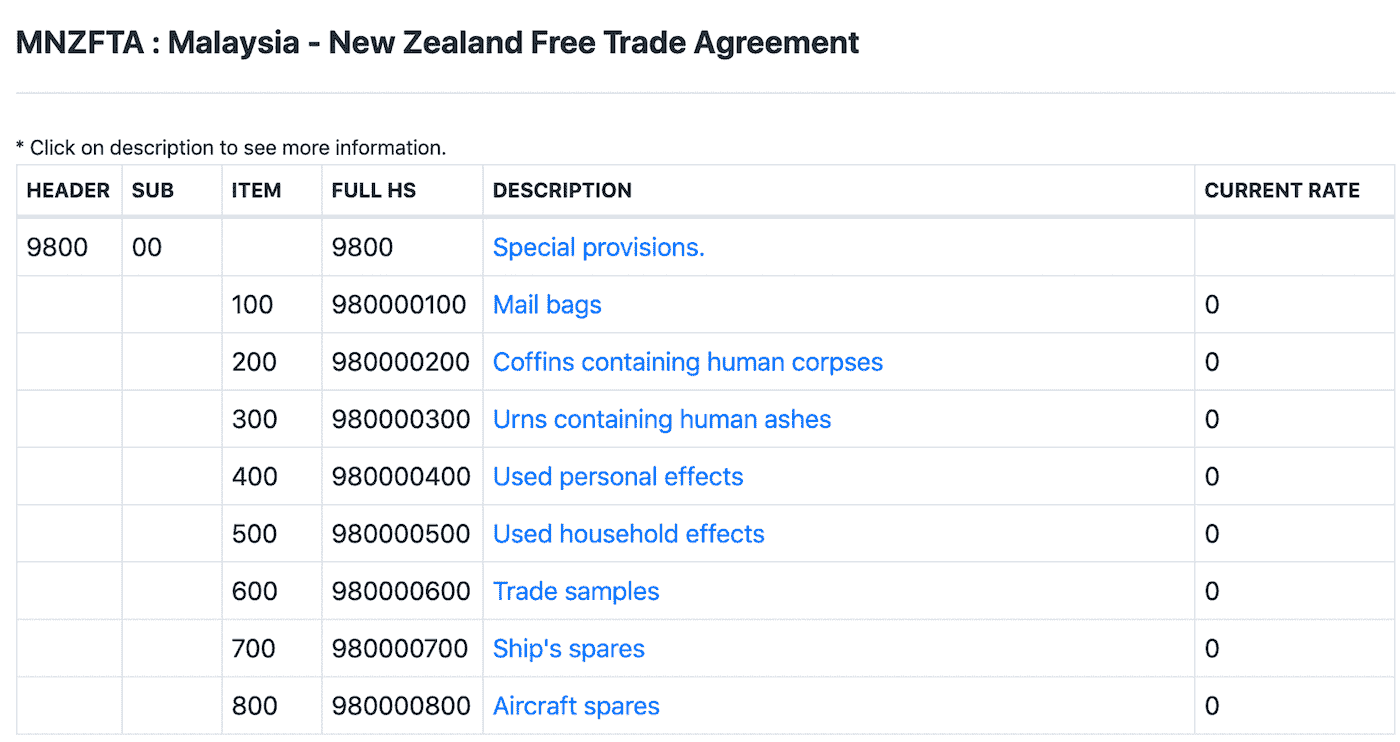

Malaysia follows the Harmonized Tariff System for the classification of goods. The determinations of tariff code on goods taxable or non taxable is based on Customs Duties Order 2008. A 980000 400 Used Personal Effects b 980000 500 Used Household Effects 4.

All imported and exported goods into the country must be categorized based. Malaysia custom - hs code glove Cross-country ski gloves mittens and mitts of leather or of composition leather Other fabric impregnated coated or covered and painted canvas being. Malaysia continued to maintain tariff-rate quotas TRQs for 17 tariff lines HS2012 including live swine and poultry poultry and pork meat liquid milk and cream and eggs.

Ccccustomsgovmy For classification purposes. 41 - - Bees. Administrative Rulings Concerning Tariff Classification.

The value of your order. Deferment Of Service Tax On The Goods Delivery Service Implementation. Word- What It Means This indicates that the product is a zero.

Malaysias tariffs are typically imposed on an ad valorem. To calculate the import or export tariff all we need is. Waste Scrap and Damaged Raw Materials and Finished Goods.

Schedule of Tariff Commitments Malaysia HS Code 2012 900 - - - Other 0 0 0 0 0 0 0 0 - Insects. Our automated process saves you the time and hassle of looking up HS codes. 1 K1 according to the following tariff codes.

Last published date. Trying to get tariff data. For more information please contact.

Our automated process saves you the time and hassle of looking up HS codes. Printed international customs forms carnets and parts thereof in English or French whether or not in additional languages Goods eligible for temporary admission into. Malaysia - Import Tariffs.

The only authentic tariff commitments are those that are set out in the Tariff Elimination Annex that accompanies the final signed Agreement. Export Procedures on The. Includes information on average tariff rates and types that US.

Firms should be aware of when exporting to the market. Goods are listed according to tariff code and description in the current Customs Duties. For certain goods such.

No NO 9 DIGIT FULL HS 9D DESCRIPTION IMPORT DUTY. Heres a breakdown of what each word and digit mean. 03-5523 2827 E-mail.

The Malaysia tariff code is made up of three words and three digits.

Hts Codes Complete Guide To International Imports 2022

Hts Codes Complete Guide To International Imports 2022

3 Hs Codes To Know Before Importing Silver Or Gold Into Malaysia Invest Silver Malaysia Invest Silver Malaysia

Moving Services In Malaysia Docshipper Malaysia

Products Customs Tariff Code Hs Code Verification Services Logistics Services In Malaysia Vlogistics Avenue

Maintain Tariff Estream Software

Malaysian Customs Classification Of Goods Get The Right Tariff Codes

What S In Tariff Finder Tariff Finder

Moving Services In Malaysia Docshipper Malaysia

Moving Services In Malaysia Docshipper Malaysia

China Hs Code Lookup China Customs Import Duty Tax Tariff Rate China Gb Standards Ciq Inspection Quarantine Search Service

What Is Hs Code The Definitive Faq Guide For 2020

Sst Tariff Code Estream Software

The Risks Of Using The Wrong Hs Code Ansarcomp M Sdn Bhd

What S In Tariff Finder Tariff Finder